Data Ownership, Micro-Communities, & the Role of Blockchain

Table of Contents

- Introduction

- Understanding Blockchain

- Blockchain's Ancient Origins

- The Rise of Small-World Networks

- Micro-Communities: The Unsung Heroes in the Saga of Data Ownership

- Micropayments: The Threads Weaving the Economic Fabric of Micro-Communities

- The Silent Revolution in the Realm of Data Ownership

- Conclusion

- Epilogue: Charting the Course in the Ocean of Data Ownership

Introduction

In the vast digital expanse where data flows like the lifeblood of our interconnected world, understanding who holds the reins to this immense power becomes crucial. Blockchain, a new digital plumbing infrastructure, transforms our understanding and interaction with data. It’s not just a technological marvel; it’s a paradigm shift in data ownership.

Blockchain might have first appeared on the stage as the underlying technology for cryptocurrencies, but its role is far more profound. It's a custodian of trust, a [sufficiently] “decentralized” ledger that stands as a bastion against the monopolistic control of data that currently exists among major tech companies.

It’s a technology that doesn’t just manage data; it redefines its very ownership.

Understanding Blockchain

Blockchain is often described in various ways, so let’s explore some of the most popular, then our own.

According to Investopedia, “blockchain is a distributed database or ledger that is distributed among the nodes of a peer-to-peer [P2P] network.” According to the Oxford Dictionary, blockchain is “a system in which a record of transactions, especially those made in a cryptocurrency, is maintained across computers that are linked in a P2P network.”

In Bitcoin, blockchain is used as a “ledger-of-choice” in which it records its transactions. Why? Because it is essentially a chain of blocks that gets increasingly more difficult to tamper with as the chain’s length increases.

And in the original design of Bitcoin, groups called “miners” get rewarded for “mining” the blocks in the Bitcoin blockchain — with the rewards halving in value every 4 years (a part of its game theory). If you’re unfamiliar with the concept of blockchain mining, take this definition from Blufolio:

“Blockchain miners are individuals who have the computer hardware and appropriate software needed to mine digital currencies or solve complex mathematical problems. The mining process is referred to as “proof-of-work” (proof-of-work, PoW), which is one of many ways to secure a blockchain.”

Blockchain's Ancient Origins

If we move further back in history, there’s a interesting story about a Micronesian population known as the Yapese. According to a story depicted by Australia’s Westpac bank, the Yapese were one of the earliest groups to attempt a blockchain-like system to record transactions — using just their own memories, nothing digital.

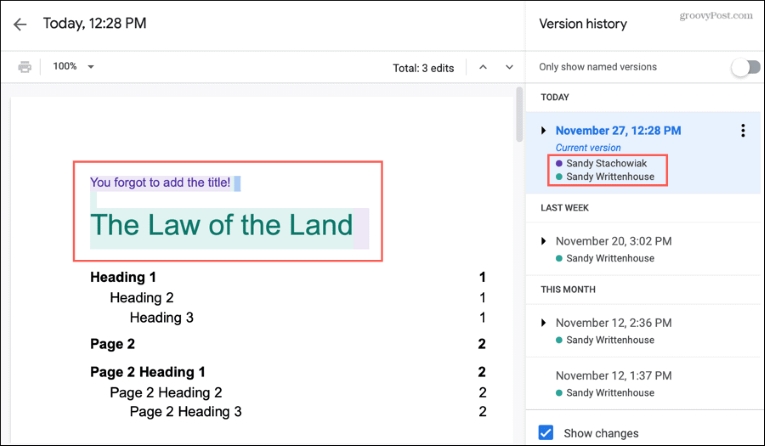

After watching the video, if you’re still confused about the mechanics of blockchain, try this analogy. Imagine blockchain being a simple spreadsheet. Every time someone makes a change, that change is recorded. And because the blockchain is “public,” you can view that change without revealing the content of that change. This is akin to the Version History feature that exists both on Excel and even Google Sheets.

See below:

Image source: https://www.groovypost.com/howto/restore-or-copy-document-versions-in-google-docs-sheets-and-slides/

And so imagine each change in the above right column, being a “transaction” on the blockchain ledger. Those transactions can be so minute, and cost so little, you barely notice. But if you had an instance where someone tried to take advantage of you — say a larger, more powerful player — if all the world’s data was stored “on-chain,” via micropayments, then that audit trail of “data micropayments” could then be used in a court of law to help the little guy.

Most people do not think about the ramifications of this, but this is an example of how blockchain technology truly brings power “back to the people” — or at least levels the playing field.

The Rise of Small-World Networks

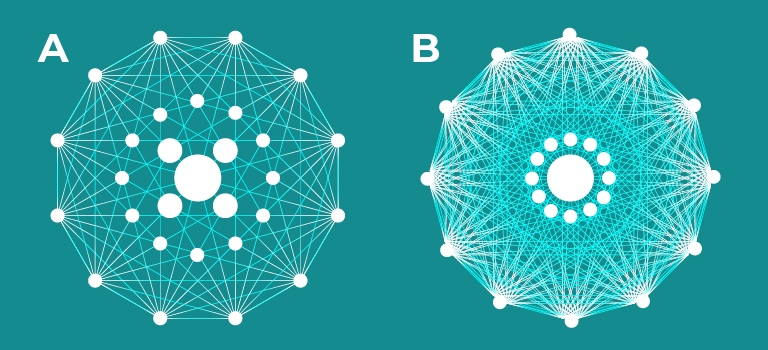

Small-World Networks (SWNs) are a form of network topology often mentioned in Computer Science or Network Theory. More specifically, blockchains like Bitcoin are built on Mandala Networks, which are ultra SWNs.

How this relates to the average person, is that it takes the concept of a “small world effect” and places it directly into the micropayments infrastructure design of Bitcoin. You experience this effect in real-life, when you travel great distances and somehow manage to “bump into” someone who knows someone you know. It allows you to travel far, while still staying connected.

In the age of social media, “micro-communities” (which are a form of Small-World Network) are rising up as powerful entities. They’re typically groups of 30 or less, but are more than just gatherings; they are hubs of shared passions and pursuits. And are where most movements begin.

In these spaces, the concept of data ownership takes on a new dimension. In the business world, these micro-communities are goldmines of insights and opportunities, because they are small clusterings within a wider network.

So blockchain isn’t just about securing data, it’s also about redistributing value. It’s where data ownership gets real – tangible, measurable, and rewarding.

Micro-communities are —ironically— becoming a big thing.

— Arvid Kahl (@arvidkahl) October 13, 2023

Dive into the world of niche online communities and discover their life-changing potential. From monetization to deep connections, it's all here.

And it's getting easier and easier to start. https://t.co/tvHM71SQAs pic.twitter.com/W9X40wSgK8

Micro-Communities: The Unsung Heroes in the Saga of Data Ownership

Nestled within the broader digital universe are micro-communities, each a unique tapestry of shared interests and collective goals. These are not just groups; they are ecosystems in their own right, thriving on the exchange of ideas and information. Blockchain steps in as a silent partner, empowering these communities to take charge of their data, to own it, manage it, and benefit from it.

In these micro-communities, blockchain emerges as a beacon of trust and transparency. It’s a system where the authenticity of information is not just a promise but a guarantee. Here, data is not just shared; it's protected, with each member playing a part in its guardianship.

Blockchain also pioneers a new economy within these micro-communities – an economy where data is not just a commodity but a currency. This isn’t about big corporations monetizing data; it’s about the individual, the creator, the member, reclaiming their right to their digital footprint.

Micropayments: The Threads Weaving the Economic Fabric of Micro-Communities

In this digital tapestry, micropayments are the fine threads that bind the economic fabric of micro-communities. These are not just transactions; they are the subtle exchanges that fuel the growth and sustainability of these groups.

Micropayments do more than just facilitate trade; they empower voices within these communities. They enable creators to monetize their craft, their content, their data. This is where data ownership is not just a concept but a practice, a lived experience.

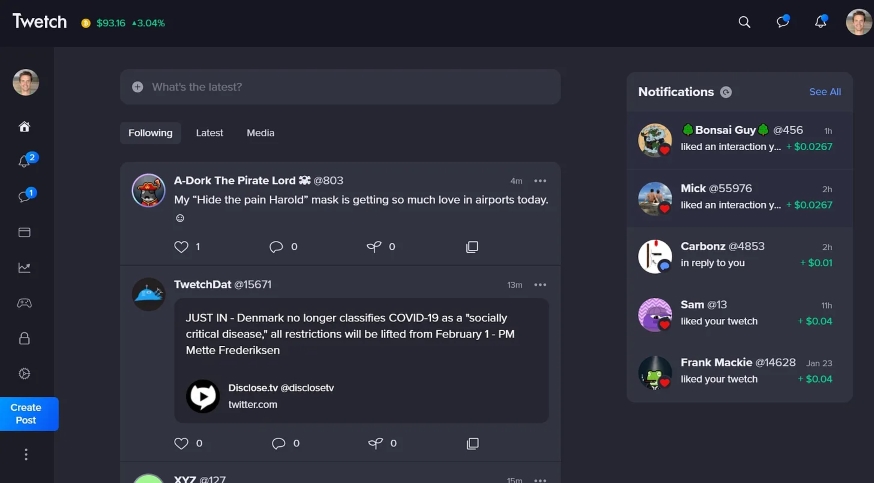

In platforms like Twetch, you can already see how micropayments influence the way online behaviors take shape. People get paid directly (in direct micropayments) for likes, comments, and even re-shares:

Image source: https://nanopay.substack.com/p/app-spotlight-twetch

Elon Musk is already looking at these technologies to enable micropayments for platforms like X in the near future. But Twetch has been able to show people what that type of future looks like already.

But where do the micropayments come from? They still need to be bought using traditional fiat (in order to get the tokens), then it can be used.

Closest example of this is how we use ChatGPT. When you buy a Plus subscription, you’re actually purchasing tokens in the background for AI-generated results. But you never really need to think about it.

This is also why blockchain would be a great solution for AI systems, because then market forces would self-regulate how AI is used across the board. And the “payments” [micro] would be small enough so that anyone should be able to use.

Through blockchain-based micropayments, collaborative endeavors find new life. Here, pooling resources isn’t just about gathering funds; it’s about enabling individuals, easing the ability to trade online, and providing a trustworthy network to do it on.

The Silent Revolution in the Realm of Data Ownership

As we delve deeper, it’s evident that blockchain’s role transcends the confines of digital currency. It’s a somewhat silent revolution, reshaping the landscape of data ownership, turning each participant into a guardian, a custodian of their digital identity.

In the music industry, blockchain-based micropayments offer an interesting opportunity for music artists. They provide artists with a fairer and more transparent way to monetize their work. With traditional payment systems, artists often face challenges in receiving their rightful earnings due to intermediaries and complex royalty structures. However, blockchain technology enables direct P2P transactions, allowing artists to receive immediate and transparent payments for their music. This not only empowers artists financially but also promotes a more equitable and sustainable music ecosystem. By leveraging blockchain-based micropayments, artists can better control their revenue streams and build direct relationships with their fans, leading to a more vibrant and artist-centric music industry.

→ How Blockchain Can Solve the Music Industry's AI Problem (by Inder Phull)

Another example of blockchain being useful for data ownership comes from mintBlue. MintBlue is a platform that provides an enterprise-first SDK for product teams in need of absolute data control. Making it easy to implement immutable storage and identity authentication at scale.

In March of 2023, they held a world record for most number of transactions on a Proof-of-Work (PoW) blockchain. They hit a whopping 50 million transactions in 24 hours — a level needed for a future where scaleable transaction processing will become paramount.

Conclusion

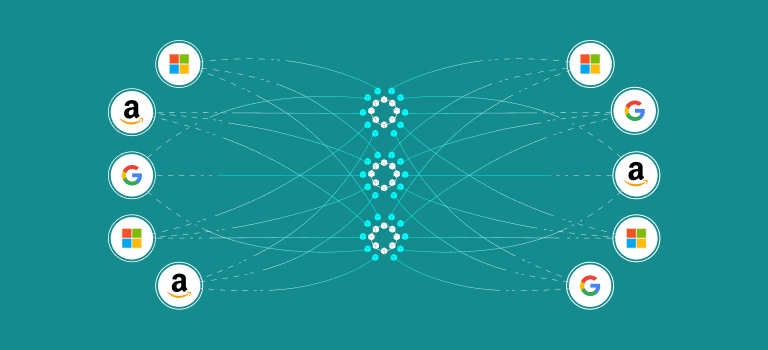

In this new era, blockchain rewrites the rules of data management. It’s not about storing data; it’s about stewarding it. In today’s paradigm, there is a lot of worry around “who’s” hosting our data (e.g. Microsoft Azure, Amazon Web Servers, etc.). However, in a blockchain world, our data is distributed across multiple data servers via the blockchain. No one company is responsible for hosting all your data, but they can be involved in the process of validating transactions (just like a bank does today, but in a more “decentralized” manner).

This type of future system, where control is sufficiently decentralized, has every participant holding the means to see how their data is being used more transparently.

In a blockchain-driven economy, data ownership is given back to the people. It’s a world where each individual becomes an entrepreneur of their own data, navigating the digital marketplace with the confidence of ownership and the power of control.

Charting the Course in the Ocean of Data Ownership

As we stand at the crossroads of this digital evolution, blockchain emerges as more than just a technology; it’s a compass guiding us through the complex seas of data ownership. It’s a journey of empowerment, of reclaiming control in a world where data is as valuable as gold.

In this journey, challenges such as scalability and energy efficiency are but stepping stones, opportunities for innovation and collaboration. Blockchain is not just a tool; it’s a vision of a future where data ownership is not just understood but embraced, where every individual is not just a user but an owner.

In the grand narrative of data ownership, blockchain is more than a chapter; it’s a turning point, a catalyst for change. As we navigate this uncharted territory, the promise of blockchain in empowering individuals and communities becomes not just a possibility but a reality.